The Recession Monster Maybe Not As Bad As Feared

Legendary investor, Howard Marks, wrote in a 2016 memo that “in the real world, things generally fluctuate between ‘pretty good’ and ‘not so hot.’ But in the world of investing, perception often swings from ‘flawless’ to ‘hopeless.’” After a seemingly hopeless 2022, investors’ perceptions have shifted, causing risk assets to rally strongly. Indeed, in the first month of the year, large companies (as measured by the S&P 500) were up 6.3%, small companies (S&P 600) were up 9.5%, and international equities (MSCI EAFE) were up 8.1%.

Besides the flip of a calendar, what has changed? Very little in the real world.

- The Fed is still raising interest rates;

- company margins continue to decline from record-high levels;

- inflation is decelerating but remains high year-over-year;

- geopolitical tensions remain elevated;

- and the consensus still anticipates a mild recession.

Investors’ perception, however, has improved markedly. We wrote in 2020 that the scariest part of a horror film is not the monster’s reveal; instead, it’s the apex of anticipation just prior, when imaginations are running wild. Often the reveal leads to a sigh of relief. Investors built up a lot of fear last year and may now see that the monster might not be so scary after all. Surveys of investors confirm the shift in sentiment. The American Association of Individual Investors recorded peak bearishness among those polled in September 2022 but now reports the most bullish views in a year.

The last several years of economic data may have triggered investors’ overreaction. Following the loss of 21.7 million jobs at the onset of the pandemic, one could be forgiven for leaning toward a hopeless sentiment. Similarly, the initial strength of the rebound could easily have led one down the path of believing that the economy was flawless. However, three years after the onset of COVID, most data is stunningly close to where one might have predicted it to be, absent a global pandemic in the middle.

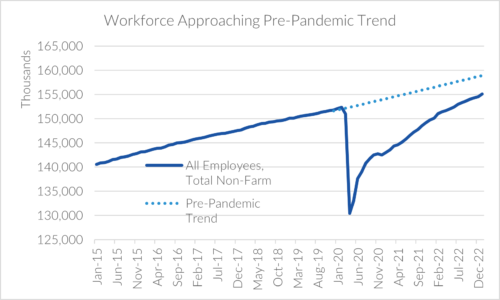

Workforce

Source: U.S. Bureau of Labor Statistics

The workforce is now larger than it was before the pandemic and is closing the gap to where it’s pre-pandemic trend suggested it should be. While imbalances in the distribution of labor between sectors remain, generally, anyone who is qualified to have a job and wants one can get one. One of the more frustrating elements of the post-pandemic labor market is that the hurdle for working is now higher. Whether it’s the increased cost of childcare, a preference for remote work or the gig economy, or simply a reprioritization of values; many who have left the official labor force since the pandemic started have been reticent to return. The latest payroll numbers, a jaw-dropping 517 thousand new jobs, came with an increase in the labor force participation rate. The latter might suggest that would-be employees are being lured back to the workforce for the right price.

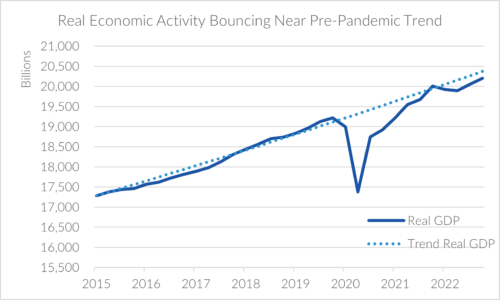

Economic Growth

Source: U.S. Bureau of Economic Analysis

The value of the economy is also remarkably close to where one might have predicted pre-COVID. After an unprecedented 29.9% annualized decline in the second quarter of 2020, it roared back by an annualized 35.3% in the third quarter. By the end of the first quarter of 2021, it regained its pre-pandemic level and now sits slightly below the trend line.

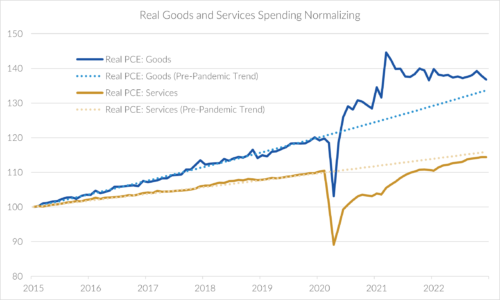

Similar to the workforce, the imbalance of the recovery in various sectors was challenging. While many people quickly returned to work and the government pumped money into household checking accounts, most services that require in-person experiences remained closed. Instead, consumers nested in their homes with new TVs, furniture, and other goods. In many cases, they bought new homes. This pushed goods spending well above the pre-pandemic trend. For the last year, however, spending on goods has moderated back to its long-term trend. Service spending, on the other hand, is just now getting back on track.

Source: U.S. Bureau of Economic Analysis

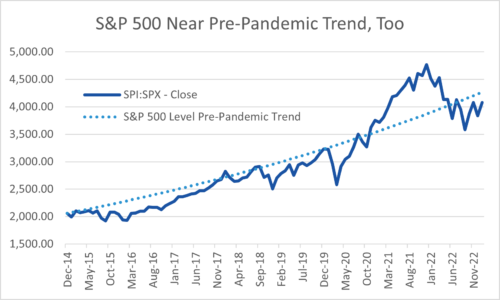

The Stock Market

The stock market has followed a similar pattern. After one of the fastest bear markets in history, it reached new highs at a torrid pace. In 2022, it retreated toward its long-term trendline (and even broke below it). At the end of January, it was within 5% of where one might have predicted it might be. Given the magnitude of the economic changes outlined above and the pace of the Fed’s tightening campaign, we would suggest that the market is closer to “pretty good” than it is “hopeless.”

Source: Standard & Poors

Looking Forward

We welcome the return to a more normal economic environment that oscillates between “pretty good” and “not so hot.” With jobs, GDP, and spending now in line with their historical trends, it is our opinion that the investment markets’ most significant moves are behind us. Inflation has further to fall, but we are optimistic that it is moving in the right direction. Our optimism for the equity markets is not as strong, however, as in the short-term, markets are driven more by sentiment than long-term fundamentals. For traders, these sentiment sways between flawless and hopeless highlight the risks in trying to time the market; however, for disciplined investors, the landscape may be starting to look pretty good.